Display Title

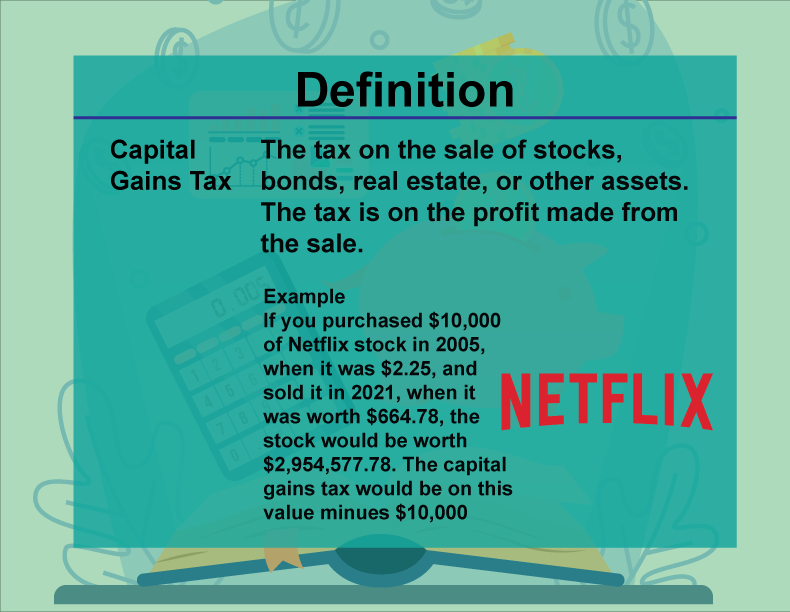

Definition--Financial Literacy--Capital Gains Tax

Display Title

Definition--Financial Literacy--Capital Gains Tax

Definition--Financial Literacy--Capital Gains Tax

This is part of a collection of definitions on Financial Literacy. This defines the term capital gains tax.

—Click on PREVIEW to see the definition—

To see the complete set of definitions on Financial Literacy, click on this link

Note: The download is an image file.

Related Resources

To see additional resources on this topic, click on the Related Resources tab.

Create a Slide Show

Subscribers can use Slide Show Creator to create a slide show from the complete collection of math examples on this topic. To learn more about Slide Show Creator, click on this Link:

Accessibility

This resource can also be used with a screen reader. Follow these steps.

-

Click on the Accessibility icon on the upper-right part of the screen.

-

From the menu, click on the Screen Reader button. Then close the Accessibility menu.

-

Click on the PREVIEW button on the left and then click on the definition card. The Screen Reader will read the definition.

| Common Core Standards | CCSS.MATH.CONTENT.HSA.CED.A.1 |

|---|---|

| Grade Range | 8 - 10 |

| Curriculum Nodes |

Algebra • Expressions, Equations, and Inequalities • Numerical and Algebraic Expressions |

| Copyright Year | 2023 |

| Keywords | financial literacy, capital, Capital Gains Tax, Capital Loss |